In Ada County, plummeting mortgage rates are making a big difference; the average buyer is saving $500 per month compared to just a few months ago. Combined with a slight dip in home prices, lower rates are a green light for many who were previously on the fence about buying.

After reaching nearly 8% in October last year, mortgage rates have settled at just over 6%, their lowest level since early 2023. While the Federal Reserve's expected rate cut last month grabbed headlines, mortgage rates had already started dropping sharply in August, anticipating the Fed's move.

Buyers and homeowners were quick to take advantage of the lower rates. Nationwide, mortgage applications for new construction homes jumped 15% in August, and refinance originations more than doubled compared to the previous month.

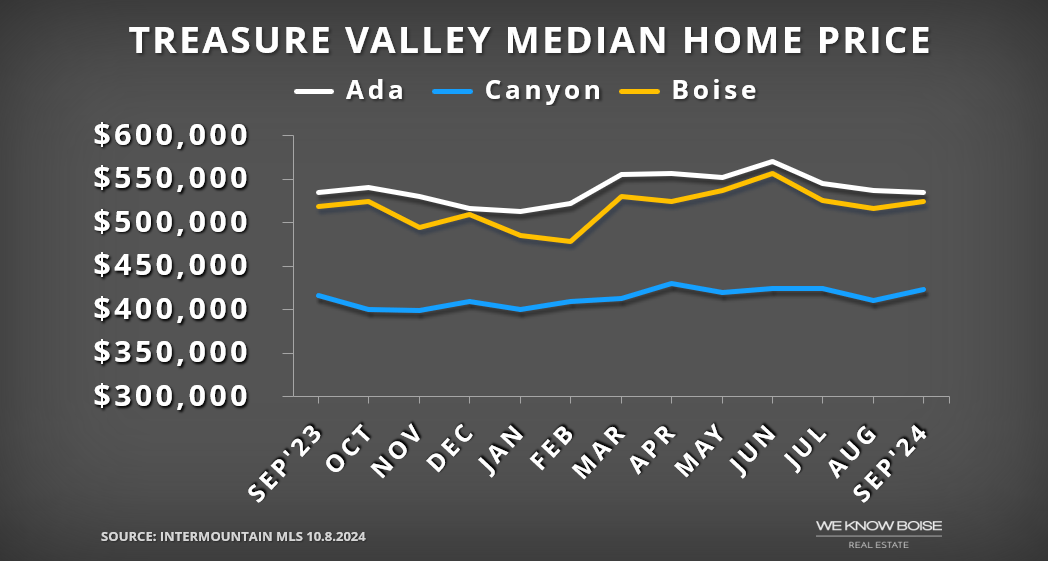

In Ada County, the median home price has fallen for the third consecutive month to $534,900, which is lower than the spring highs but essentially unchanged from this time last year. Boise saw a slight 1.2% year-over-year increase, bringing the median price to $525,000.

September's home sales reflect conditions earlier in the year when mortgage rates were a percentage point higher. A seasonal shift toward the sale of smaller homes also contributed to the monthly price dip in Ada County. Canyon County prices rose 1.9% to $423,697, in line with spring levels.

Locally, the recent drop in interest rates has sparked renewed interest from potential homebuyers after the summer slowdown. Open house traffic has increased, especially for homes under $700,000.

For our clients in higher price ranges, we haven't seen much hesitation from buyers—or sellers, for that matter. However, new home builders and other real estate agents have noted that some buyers are showing caution due to uncertainty around the upcoming election.

Historically, presidential elections have had little impact on home prices, but sales do tend to slow in the months leading to Election Day, exacerbating the typical November lull. Thanksgiving week usually marks the lowest point in annual demand.

In the Treasure Valley, there are currently 2,887 homes for sale—a nearly 24% increase from last October. At the current sales pace, this represents about a 2.84-month supply of homes. For context, economists consider a balanced market—neither favoring buyers nor sellers—to have a supply of 4 to 6 months.

Rising inventory has positively impacted home sales, which are up 14% year-to-date. The typical home is selling in around 30 days, which is slower than the Boise area is accustomed to but fast by historical standards.

Despite the shift toward a more balanced market this year, sellers remain in a relatively strong position. Homes that are in great condition, priced right, and well-marketed are selling fast. We've even seen some million-dollar properties attract multiple offers.

Overall, the local real estate market feels similar to this time last year—slightly slower than in pre-pandemic years but not out of line with a typical October.

While falling rates have attracted new buyers, uncertainty about the election has kept others on the sidelines. Additionally, some buyers develop a "wait-and-see" approach when rates are declining, hoping rates will drop even further.

Generally, lower interest rates lead to higher home prices as more buyers enter the market. If mortgage rates drop below the key 6% threshold, we could see a sharp increase in demand, which may further drive up prices.

Inventory is currently at its yearly peak and will likely decline until early spring. Any further rate decreases could unlock supply by encouraging more homeowners to sell. However, that will also lead to more competition for new homes.

If you expect mortgage rates to continue falling, the rest of the fourth quarter could play out much like last year: a gradual slowdown in demand through November, followed by a sharp uptick in activity as we head into December.

Boise Real Estate Market Summary for September 2024

- Median list price: $529,900, up $9,900 (1.7%)

- Median sold price: $525,000, up $6,000 (1.2%)

- Average price per square foot: $308 (up 2.2%)

- Total home sales: 269 (up 28)

- Median days on market: 19 days (up 4)

- Available homes for sale: 2.36 month supply (up 0.44)

- 30-year mortgage rate: 6.18% (down 1.02)

Treasure Valley Housing Market by Area

- Ada County: $534,900, down $100 (unchanged)

- Eagle: $735,000, down $72,500 (-9%)

- Garden City: $591,000 (*fewer than ten sales)

- Kuna: $459,700, up $29,710 (6.9%)

- Meridian: $519,990, up $4,990 (1%)

- Star: $515,000, down $24,900 (-4.6%)

- Canyon County: $423,697, up $7,707 (1.9%)

- Caldwell: $378,995, up $4,545 (1.2%)

- Middleton: $529,995, up $106,795 (25.2%)

- Nampa: $423,697, up $3,797 (0.9%)

More From Our Blog

Select information in this We Know Boise market report was obtained from the Intermountain MLS (IMLS) on October 8th, 2024. While the data is deemed reliable, it is not guaranteed. City-specific data refers to single-family homes on less than one acre, whereas county-level data includes homesites of all sizes. The "months of supply" metric is based on a 12-month rolling average. Home prices mentioned combine both existing and new construction properties. Comparisons are based on year-over-year changes unless otherwise specified.

Posted by Lisa Kohl on

Leave A Comment