Rising home inventory has fueled higher sales this year, while elevated mortgage costs have kept price growth in check.

For buyers, the unpredictability of mortgage rates has been almost as impactful as the rates themselves. Monthly payments have fluctuated by hundreds of dollars, creating challenges even for those who can technically afford the added expense.

Over the past two years, homebuyer demand has tended to rise when mortgage rates approach 6% but lose momentum when rates climb past 7%. The market surged in August and September as rates hit a two-year low, only to cool when rates spiked in October. Recently, rates dropped again, reaching a five-week low of 6.69%.

Despite the volatility, buyer activity has been busier than usual for this time of year, thanks to lower mortgage rates compared to last year and renewed interest following the November election.

According to the Mortgage Bankers Association, recent rate declines have pushed mortgage applications to their highest level since January. Home sales, which hit a nine-year low in 2023, have risen by 8.3% this year, driven by an uptick in housing supply.

In Ada County, sales have grown at a pace mirroring the rise in inventory, suggesting that more people are ready and able to buy homes than there are available properties.

At the start of December, there were 2,568 homes for sale in the Treasure Valley—a 16% increase compared to last year. This equates to 2.41 months of supply, meaning it would take just over two months to sell all available homes—a level that typically favors sellers.

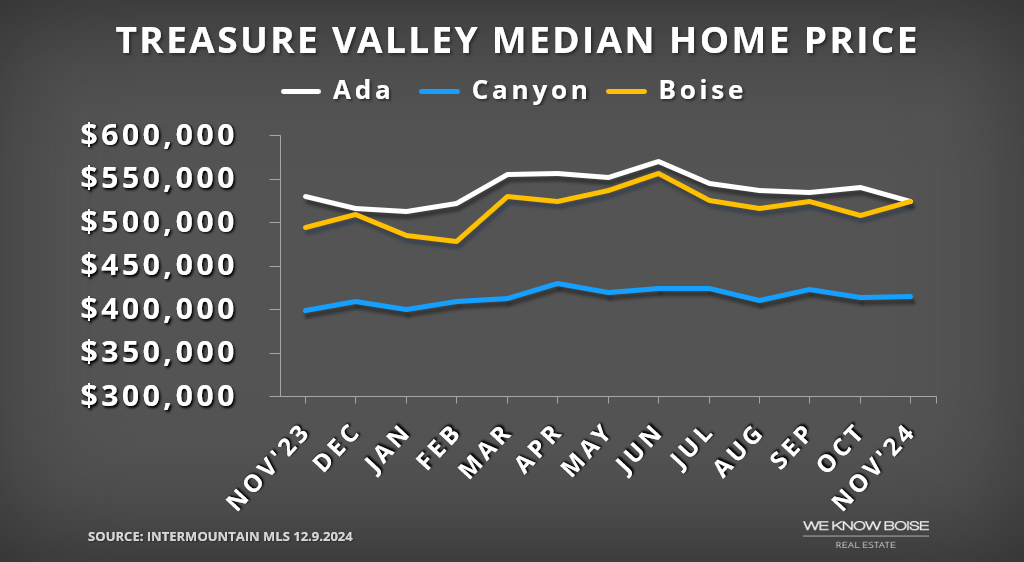

While the additional supply supported sales this fall, buyers gravitated toward more affordable options, particularly in Ada County. The median home price there dipped slightly, down 0.9% year-over-year to $525,000. Meanwhile, Boise saw a 6.1% increase to $525,000, and Canyon County experienced a 4% rise to $414,995.

All things considered, the Treasure Valley housing market is in better shape than it might appear at first glance. Nationally, home price growth is slowing, and inventory levels are rising. With prices still near record highs, a correction may be overdue.

Locally, however, prices have already dipped, rebounding slightly from 2023 lows but remaining 12% below their 2022 peak. This local decline has helped stabilize the market and reduce some of the froth created by the pandemic-fueled price surge.

Higher supply would make life easier for buyers, while lower mortgage rates would benefit everyone. Still, when viewed from a broader historical perspective, the market is closer to "normal" than it might seem.

To reach a balanced market that favors neither buyers nor sellers, the housing supply would need to increase by about 65%. Tight supply has been the norm for so long that we have almost gotten used to it. That said, inventory levels today are higher than they were in December 2019.

Stable prices in Ada County over the past year, along with rising incomes, have made homes (slightly) more affordable. While mortgage rates are higher now than they were a couple of years ago, they're not historically high. Between 1972 and 2020, the average rate was 7.81%.

Even during the lead-up to the 2000s housing crisis, rates averaged between 5.8 and 6.9%. Consider that for a moment: the greatest residential real estate bubble of the last 100 years occurred in an interest rate environment not much different from today’s.

However, while rates are comparable, inflation-adjusted home prices were lower back then. That's why affordability feels so tight today and why any drop in rates tends to spark a surge in demand. The market’s two primary constraints are inventory and affordability. When more homes are available or rates drop, demand reliably picks up.

Last month, we made the case for higher inventory in 2025. Due to the “lock-in effect,” higher supply is partially dependent on lower interest rates. Naturally, lower rates boost buyer activity, meaning mortgage rates will play a significant role in shaping the market in the coming year.

January typically sees a wave of buyers eager to secure a home before the spring market heats up, and we anticipate a similar pattern this winter. With buyer activity already gaining momentum, and with a little help from mortgage rates, the Treasure Valley market is poised for a busy start to the new year.

Boise Real Estate Market Summary for November 2024

- Median list price: $529,900, up 6.3%

- Median sold price: $525,000, up 6.1%

- Average price per square foot: $300, up 3.1%

- Total home sales: 260, up 63

- Median days on market: 22 days, down 1

- Available homes for sale: 1.81 month supply, up 0.10

- 30-year mortgage rate: 6.81%, down 0.63

Treasure Valley Housing Market by Area

- Ada County: $525,000, down 0.9

- Eagle: $857,985, up 2.7%

- Garden City: $727,700, up 11.5%

- Kuna: $429,990, down 5.4%

- Meridian: $512,735, down 1.4%

- Star: $519,813, down 4.3%

- Canyon County: $414,995, up 4%

- Caldwell: $385,250, up 5.5%

- Middleton: $539,911, up 24.5%

- Nampa: $411,417, up 3%

More From Our Blog

Select information in this We Know Boise market report was obtained from the Intermountain MLS (IMLS) on December 9th, 2024. While the data is deemed reliable, it is not guaranteed. City-specific data refers to single-family homes on less than one acre, whereas county-level data includes homesites of all sizes. The "months of supply" metric is based on a 12-month rolling average. Home prices mentioned combine both existing and new construction properties. Comparisons are based on year-over-year changes unless otherwise specified.

Posted by Lisa Kohl on

Leave A Comment