For first-time and seasoned homeowners alike, Idaho property taxes can be confusing. For instance, what’s the difference between a home’s market value and assessed value – and which one is used to calculate property taxes? And why can two very similar houses in the same neighborhood have drastically different property taxes?

If you have a home mortgage, chances are your property tax payments are rolled into your mortgage payment each month. But it’s still helpful to know what you’re paying as a homeowner and why. Below, we break down how rates are set, how you can estimate your property tax rate, and how to appeal if you believe your property taxes are too high.

What Are Idaho Property Taxing Districts and Why Do They Matter?

Property taxes are important – cities and counties depend on them to fund valuable public services (like schools) and infrastructure development (like new streets and sidewalks). Each of these is a unique “taxing district.” Taxing districts are based on where you live, which is why exact tax rate changes between counties and even cities.

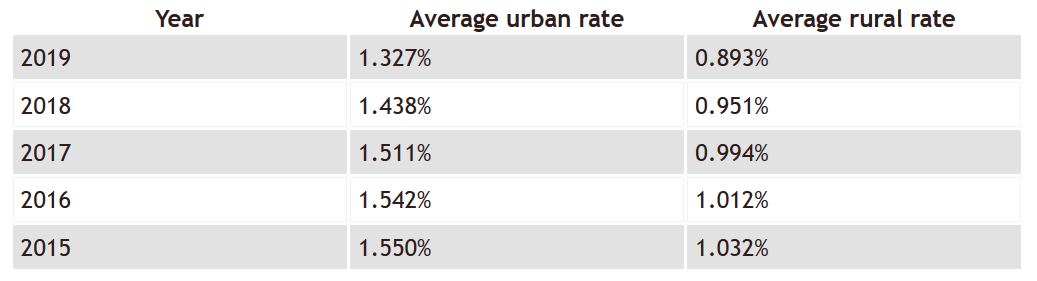

Idaho has more than 1,245 unique taxing districts alone, which gives you an idea of how complicated your property tax bill can be. The more residents in a city or county, the more demand there is for public services. That’s why tax rates are generally higher in more populated counties than in rural ones. In fact, the statewide average urban tax rate is 1.327%, while the rural rate is 0.893%.

The City of Boise – Idaho’s largest city, located in Ada County – has a helpful breakdown that shows how each property tax dollar that comes to the city is spent.

Idaho Property Tax Rates

How Are Idaho Property Tax Rates Calculated?

Each county has a Property Tax Assessor who annually evaluates all properties and sets a unique tax rate for each. It’s important to note that the assessor doesn’t use the straight market value of your home (or what a buyer might pay for it) for taxing purposes, they use the "assessed value" of your property.

The market value of your home is the price it would likely sell for today. The assessed value of your home is based on the average prices of homes similar to yours that have recently sold. The assessed value will typically be lower than the market value in an upward trending market and higher in a downward trending one.

Once every five years, an appraiser from the county assessor’s office must visit your property to conduct an in-person assessment. Otherwise, the assessor creates an assessed value for your property based on the sales of comparable homes in your area. Factors can influence the assessed value, including the property’s size, quality, location, age, and condition. Your assessed property value is stated on your annual assessment notice, which is usually mailed out the first week of June.

Simply put, you can calculate your property taxes by taking the assessed value of the property, minus any exemptions and multiplying that by the levy rate.

(Assessed Value – Exemptions) x Levy Rate = Property Tax Amount

Let’s say you and your across-the-street neighbor both own three-bedroom homes that sit on a quarter-acre of property. The houses were built in the ‘70s, however, your home has a canal running along the back edge of the property. It also has a new roof, siding and windows, and the addition of a front and back porch.

Because of the canal, a mosquito abatement taxing district is applied to your property (in addition to the county tax levy) but not your neighbor’s. Your levy rate is 0.00257, while your neighbor’s rate is slightly lower at 0.00255. And because of the upgrades and additions to your home, your home’s assessed value is higher, too (let’s say at $300,000 after exemptions versus your neighbor’s at $230,000). Now let’s apply our formula to find out how much you’ll each be taxed:

Your home: $300,000 x 0.00257 = $771

Your neighbor’s home: $230,000 x 0.00255 = $587

As you can see, you will be paying significantly more in property taxes on a home that is very similar in size, age and style as your neighbor’s.

The tax rate you pay can also fluctuate from year to year. In Idaho, taxing districts can increase taxes up to 3% annually (plus growth). Each year, the Idaho State Tax Commission double checks each county to try and ensure that properties are being assessed correctly.

Sample Ada County Tax Bill

1) Taxing Districts

2) Taxable Value

3) Levy Rate

4) What you Owe

How Idaho Property Taxes Compare to Other States

Like most taxes, Idaho's property taxes are lower than the national average. A recent report from the Idaho State Tax Commission shows that for a typical family of three in Boise earning $75,000 per year, "income taxes were 3% lower than the national average, sales taxes 7% lower, and property taxes 26% lower".

When you look at property taxes in Idaho versus its neighbors, Idaho mostly comes out on top (only Nevada's taxes are lower). And when you consider all of the U.S., Idaho's per-capita property taxes rank 42nd in the nation.

What Is the Homeowner’s Exemption and How Do I Apply?

Homebuyers in Idaho are in luck: the state offers a generous homeowner’s exemption for property taxes, which can only be applied to your primary residence. The exemption is equal to 50 percent of the net taxable value of your property, plus up to one acre of land, and is capped at $100,000 for 2020.

While the homeowner’s exemption is the most widely-used property tax exemption, there are others. Some homeowners in Idaho – select veterans and disabled individuals on fixed incomes, for example – are eligible for Idaho’s Property Tax Reduction program (commonly referred to as a circuit breaker). This program can reduce taxes by as much as $1,320.

Common exemptions include:

- Homeowners

- Persons age 65 or older

- Widow(er) of any age

- Disabled individuals

- Household with income below $30,050

The Idaho State Tax Commission administers the program but individuals must apply through their county assessor’s office. See eligibility requirements here.

Estimating Your Bill With Idaho’s Property Tax Calculator

We’ve illustrated how complicated getting a handle on property tax rates in Idaho can be. The Idaho State Tax Commission is aware of it, too, which is why the commission created an online property tax calculator to help homeowners estimate their current year’s tax amount. The easy-to-use tool allows you to select your county, plug in your home value, then select your tax code area to find your estimated property tax.

However, the calculator has a few limitations. It can only calculate property taxes in 24 of Idaho’s 44 counties (the good news is, Ada County is one of those counties). It’s also only available late May/early June of each year through September, when counties begin assembling and sending out their tax bills.

Average Property Taxes by County

Ada County

1.193%

Canyon County

1.422%

Kootenai County

0.949%

Bonneville County

1.462%

Bannock County

1.665%

Twin Falls County

1.549%

Bingham County

1.493%

Bonner County

0.786%

Nez Perce County

1.826%

Latah County

1.637%

* Average property tax rates in Idaho's ten most populous counties in 2019.

How to Appeal Your Assessed Property Value

Let’s say you disagree with the assessed market value of your property. If this is the case, you’re within your rights to appeal it.

On the assessment notice you received in the mail, you’ll find your appraiser's contact information and the deadline to appeal. The assessor’s office encourages you to attempt to settle disputes by calling their office or your appraiser.

If you still aren’t satisfied, you can appeal by filling out a property assessment appeal form. From there, you’ll go before the Ada County Board of Equalization, where you have a chance to prove that the assessed value of your property isn’t accurate.

A helpful tip from the Ada County Assessor notes, “In presenting your appeal, the best evidence is typically sales data from the marketplace, written analysis from a realtor or other professional source.”

It’s also good to note that residents can’t protest values from previous years, so if you’re using sales data to support the valuation of your property, it should be taken within the previous year.

Leave A Comment