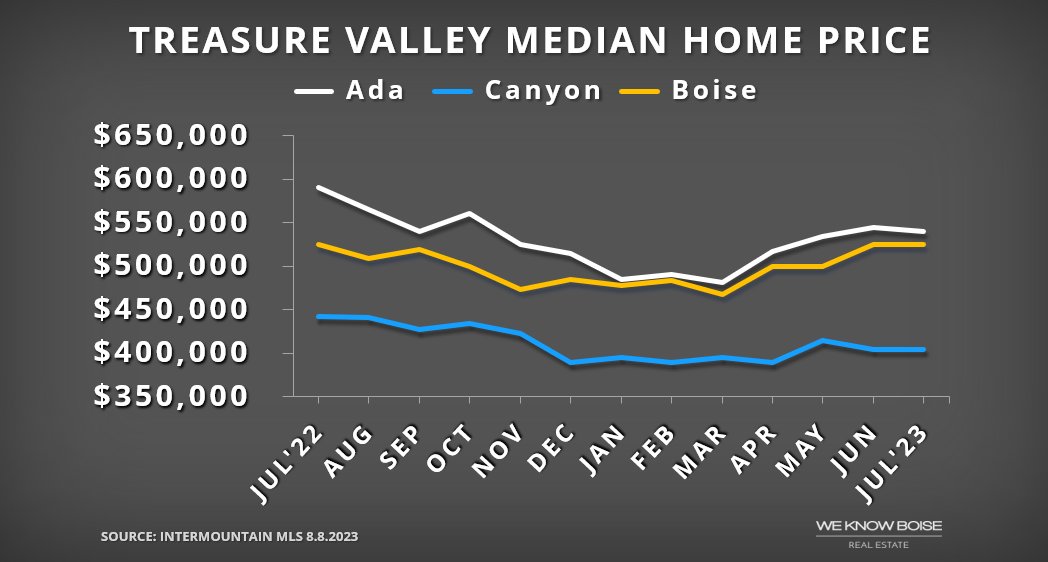

Despite softer demand, a limited supply of homes for sale has driven Ada County housing prices higher in 2023.

Since the beginning of the year, prices in Ada County have surged by 11%, with some sought-after neighborhoods experiencing even larger gains. In contrast, Canyon County has experienced a more modest 3% increase.

While this year's demand is lower than in previous years, the supply is even scarcer, leading to rising prices. Except for the 2020–21 period, there are fewer homes on the market now than in any August over the last decade.

At the end of July, the median price of a single-family home was $540,000 in Ada County and $404,990 in Canyon County, virtually unchanged from the previous month.

The gains in 2023 follow a decline in the previous year. On a yearly basis, Ada County home prices are down by 8.5%, and Canyon County by 8.4%. After falling as much as 15% earlier in the year, July prices in Boise remained unchanged compared to a year ago.

After briefly favoring buyers in the final quarter of last year, the Treasure Valley housing market shifted toward sellers this spring. Attendance at open houses and property showings in 2023 has surpassed 2019 levels, suggesting pent-up demand.

Potential buyers have been watching and waiting. They have the means to buy but are hoping home prices will continue to fall. Their decision to jump into the market could push prices even higher.

Following a sharp rise in 2022, mortgage rates have fluctuated between 6% and 7% this year. Although higher rates have reduced budgets, buyers have largely adapted to this new norm.

Across the Treasure Valley, supply remains the biggest issue facing would-be buyers. The number of newly listed homes in July plunged by 28% compared to last year, with total inventory shrinking by over 40%. At the current sales pace, there is a 2.18-month supply of homes in Ada County and a 2.03-month supply in Canyon County.

As the market shifts back in favor of sellers, there has been a reduced need for incentives to attract buyers, especially for new homes. However, builders are still strategically employing "interest-rate buydowns" to lure potential buyers. An interest-rate buydown occurs when the seller pays a fee upfront to the lender, resulting in a reduced interest rate and, consequently, a smaller monthly mortgage payment. This situation can be especially beneficial for first-time buyers, as it often results in a lower mortgage payment than a price reduction would.

Even better for the builders, recent home price increases mean they can offer buydowns with minimal impact on their profit margins.

As of the week ending August 3, the average 30-year mortgage rate was 6.9%. Most homeowners have rates significantly below that level and are reluctant to purchase a new home if it means taking on a higher rate.

The scarcity of homeowners selling has resulted in new construction accounting for 40% of total listings at the start of August, compared to a historical norm of less than 20%.

Despite the supply crunch, buyers are reluctant to compromise due to escalating interest rates and home prices. Prospective homebuyers are taking their time, often overlooking pricier properties needing major updates or renovations.

In addition to the time and hassle of a major remodel, the steep cost of these updates, coupled with increased borrowing costs, are hard pills to swallow for many potential homeowners.

If you're on the hunt for a deal, focus on unsold properties that were listed in the first half of the year, especially luxury or vacant homes. These properties typically provide the greatest room for negotiation. With the frenzy of the spring selling season behind us, August tends to be a good month for homebuyers. Peak inventory and reduced competition give you the upper hand in securing a bargain.

Conversely, for sellers, if your property isn't listed by mid-August, it may be wise to hold off until after Labor Day. The market often sees a notable dip in new listings come September. This lull offers a prime window for an expertly marketed property to stand out and attract serious buyers. Take advantage of this seasonal trend and let your property take center stage this fall.

Boise Real Estate Market Summary for July 2023

- Median list price: $529,000, down $11,000 (-2%)

- Median sold price: $525,000, unchanged (0%)

- Average price per square foot: $306 (-6.1%)

- Total home sales: 277 (down 18)

- Median days on market: 11 days (down 2)

- Available homes for sale: 1.71 month supply (down 0.83)

- 30-year mortgage rate: 6.84% (up 1.43)

Treasure Valley Housing Market by Area

- Ada County: $540,000, down $49,990 (-8.5%)

- Eagle: $759,900, down $100,050 (-11.6%)

- Garden City: $583,500, up $1,000 (0.1%)

- Kuna: $469,990, down $1,010 (-0.2%)

- Meridian: $527,768, down $69,132 (-11.6%)

- Star: $547,385, down $57,500 (-9.5%)

- Canyon County: $404,990, down $37,005 (-8.4%)

- Caldwell: $366,276, down $58,316 (-13.7%)

- Middleton: $421,900, down $84,682 (-16.7%)

- Nampa: $412,990, down $24,117 (-5.5%)

More From Our Blog

Select information in this We Know Boise market report was obtained from the Intermountain MLS (IMLS) on August 8th, 2023, and is deemed reliable but not guaranteed. City data refers to single-family homes on less than one acre, while county data includes homesites of all sizes. Months of supply is calculated on a 12-month rolling average. Combining existing homes for sale with new construction is the best way to gauge current home prices and Boise housing market trends. New house prices can be more volatile and can make comparisons, particularly on a month-to-month basis, less reliable.

Posted by Lisa Kohl on

Leave A Comment