Boise Rental Market & Vacancy Rates

OVERVIEW

The average rent in Boise, ID, is $2,014 per month. Boise rents have decreased by 1.6% over the past year and increased by 0.5% over the past three years. The current vacancy rate for all residential rental properties in Boise is 3.3%, up from 2.73% a year ago.

Average Rents in Boise by Property Type

The Boise rental market in Q2 2025 showed signs of continued stability after several years of rapid rent growth following the pandemic. The average rent in Boise, Idaho, across all property types was $2,014, representing a slight decrease of $33, or about 1.6%, compared to $2,047 in Q2 2024, when rent levels were near all-time highs. This modest decline suggests that, while demand remains steady, new housing supply has largely caught up, keeping prices balanced for both tenants and landlords.

For single-family homes, the average house rent in Boise was $2,187, down $82, or 3.6%, from $2,269 in Q2 2024, when the segment reached a record high. By bedroom size, 2-bedroom homes averaged $1,633, a decline of $141 (about 7.9%) from the prior year; 3-bedroom homes averaged $2,218, down $127 (5.4%); 4-bedroom homes averaged $2,711, up slightly by $21 (0.8%); and 5-bedroom homes saw a modest increase to $2,998, up $71 (2.4%) compared with Q2 2024.

Rents for larger homes have held up, while smaller single-family units have softened from last year’s highs. Renters are also becoming more selective, gravitating toward newer or updated properties and prioritizing value, condition, and responsiveness from landlords.

Turning to multifamily properties, the average apartment rent in Boise in Q2 2025 was $1,514, down only $17, or about 1.1%, from $1,531 in Q2 2024. Within this category, 1-bedroom units averaged $1,248, a small decline of $9 (0.7%) from the prior year. Two-bedroom apartments averaged $1,398, a more noticeable decrease of $118 (7.8%), while 3-bedroom units climbed to $1,895, up $76 (4.2%) year over year.

This trend highlights a market where smaller multifamily units are experiencing modest price corrections, while larger apartments remain in stronger demand. This likely reflects more households choosing rentals over ownership as home purchase costs remain elevated.

Boise Rental Vacancy Rates

Vacancy rates across the Boise rental market have also edged higher compared with the same quarter last year. The average vacancy rate for all property types was 3.30%, up from 2.73% in Q2 2024. Single-family vacancies rose from 2.38% to 3.06%, while multifamily vacancies increased from 3.09% to 3.46%.

These shifts suggest tenants now have more choices, consistent with the growing trend of renters seeking quality, location, and reliable management. With supply and demand in closer balance, Boise’s rental market in Q2 2025 appears healthy, competitive, and reflective of a maturing post-pandemic housing landscape.

Search All Boise Multifamily Investment Properties for Sale

Sales Prices by Property Type

In the second quarter of 2025, the median home price in the Boise, ID metropolitan area was $572,990 for single-family properties. The median per-unit sales price for duplexes during this period was $225,000, while fourplexes had a median of $231,250. For apartment buildings with five or more units, the median per-unit sales price was $211,160.

Income and Rental Affordability

In the Idaho rental market, verifiable monthly income is a key factor in determining tenant affordability and eligibility. Property management companies typically require tenants to have a monthly income at least two and a half to three times the rental amount.

The federal government defines affordable rent as housing costs that do not exceed 30% of a household’s income. According to U.S. Census data, the median household income in Ada County is $88,907, which translates to a monthly rent of $2,223 at the 30% affordability threshold.

Boise’s strong local economy and job market also contribute to rising median household incomes and continued stability in the rental market.

Boise Multifamily Market Report: Supply

In 2023, Ada County experienced a decline in the issuance of permits for new multifamily units despite continued strong demand from potential renters. The total number of permits dropped to 2,543 from 3,332 in the previous year. This decrease was primarily due to rising interest rates, which significantly hampered new construction activities.

Estimated Apartment Projects Under Construction in 2024

- Boise = 1,676 units

- Meridian = 794 units

- Eagle = 0 units

- Garden City = 24 units

- Nampa = 275 units

- Kuna = 49 units

- Star = 0 units

- Caldwell = 810 units

- Middleton = 0 units

Building Permits Issued for Multifamily Units by County

| Year | Ada | Canyon | Total |

|---|---|---|---|

| 2023 | 2,543 | 1,085 | 3,628 |

| 2022 | 3,332 | 1,243 | 4,575 |

| 2021 | 3,324 | 291 | 3,615 |

| 2020 | 1,312 | 750 | 2,062 |

| 2019 | 2,468 | 807 | 3,275 |

| 2018 | 2,088 | 391 | 2,479 |

| 2017 | 1,621 | 310 | 1,931 |

| 2016 | 1,345 | 460 | 1,805 |

| 2015 | 1,194 | 26 | 1,220 |

| 2014 | 2,279 | 85 | 2,364 |

| 2013 | 680 | 100 | 780 |

| 2012 | 566 | 235 | 801 |

| 2011 | 290 | 147 | 437 |

| 2010 | 34 | 65 | 99 |

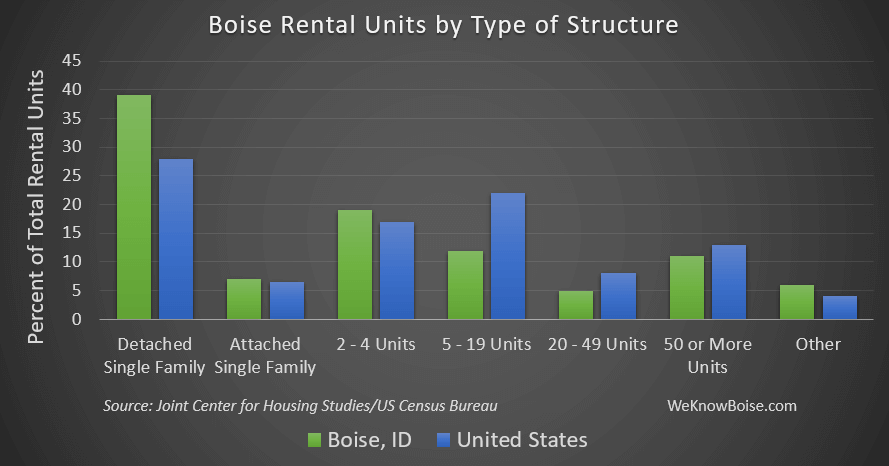

Boise Rental Units by Structure Type

Keep in mind that the Boise area still has fewer apartment buildings than a typical metro area this size. Single-unit properties, primarily houses, comprise more than half of the Boise rental market.

Boise Residential Income Property Capitalization Rates

The capitalization rate, also known as the "cap rate," is a good starting point for comparing Boise investment opportunities quickly. Many more factors need to be considered, such as the growth or decline of the potential income and the increase (appreciation) in the value of the property.

Capitalization rate = (yearly net income) / (total property value)

Speak to a Boise Income Property Expert. Contact Us or submit the form below – we look forward to assisting you.

*This We Know Boise Rental Market Report is based on a survey of 2,086 rental units. It covers the city of Boise and the surrounding areas of Meridian, Eagle, Kuna, Star, and Garden City. Select data were obtained from the Intermountain MLS, the Community Planning Association of Southwest Idaho, and the 2025 SW Idaho Vacancy Report Q2 from the Southwest Idaho Chapter of the National Association of Residential Property Managers.